CPA recently met with Transport for London (TfL) to discuss cycle parking provision ahead of the publication of the new London Plan. These discussions follow the release of our Cycling in the City report, which finds that there is significant over-provision of long-stay cycle parking for offices in the City of London. CPA Board member David Hart and Kate Pounder from Momentum Transport Consultancy explore these findings below, against recent data showing continued growth in cycle trips. You can read our full report here.

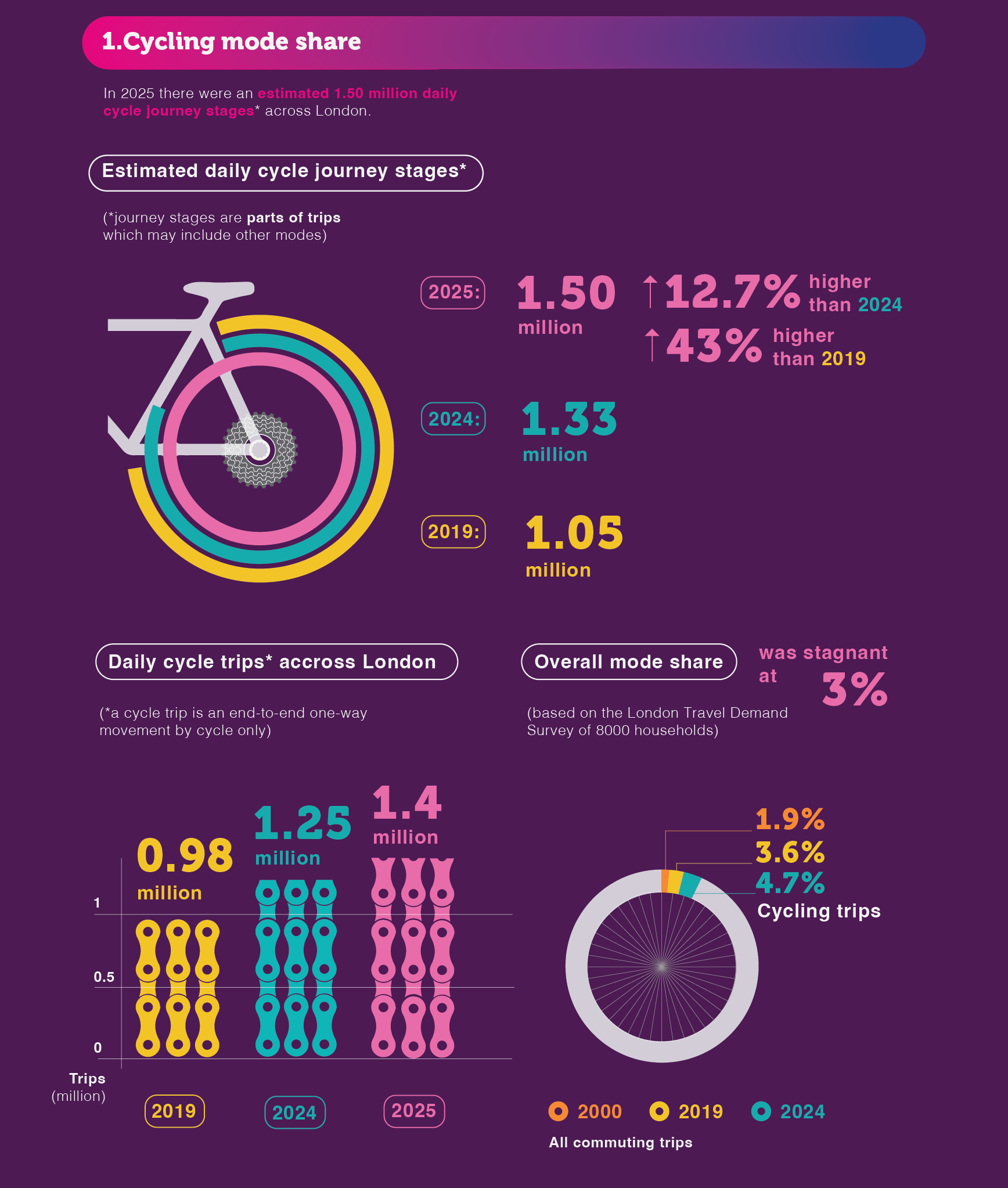

Recent TfL data shows strong growth in cycling. According to the latest Travel in London report, both daily cycle trips (defined as end-to-end journeys made entirely by bike) and cycle stages (where cycling forms part of a longer journey) have increased by almost 45% since 2019. TfL estimates that in 2025 there were around 1.5 million daily cycle stages and 1.4 million daily cycle trips within London.

At first glance, this growth would suggest that cycle commuting is also increasing. However, a closer look at who is cycling, and for what purpose, reveals a more nuanced picture.

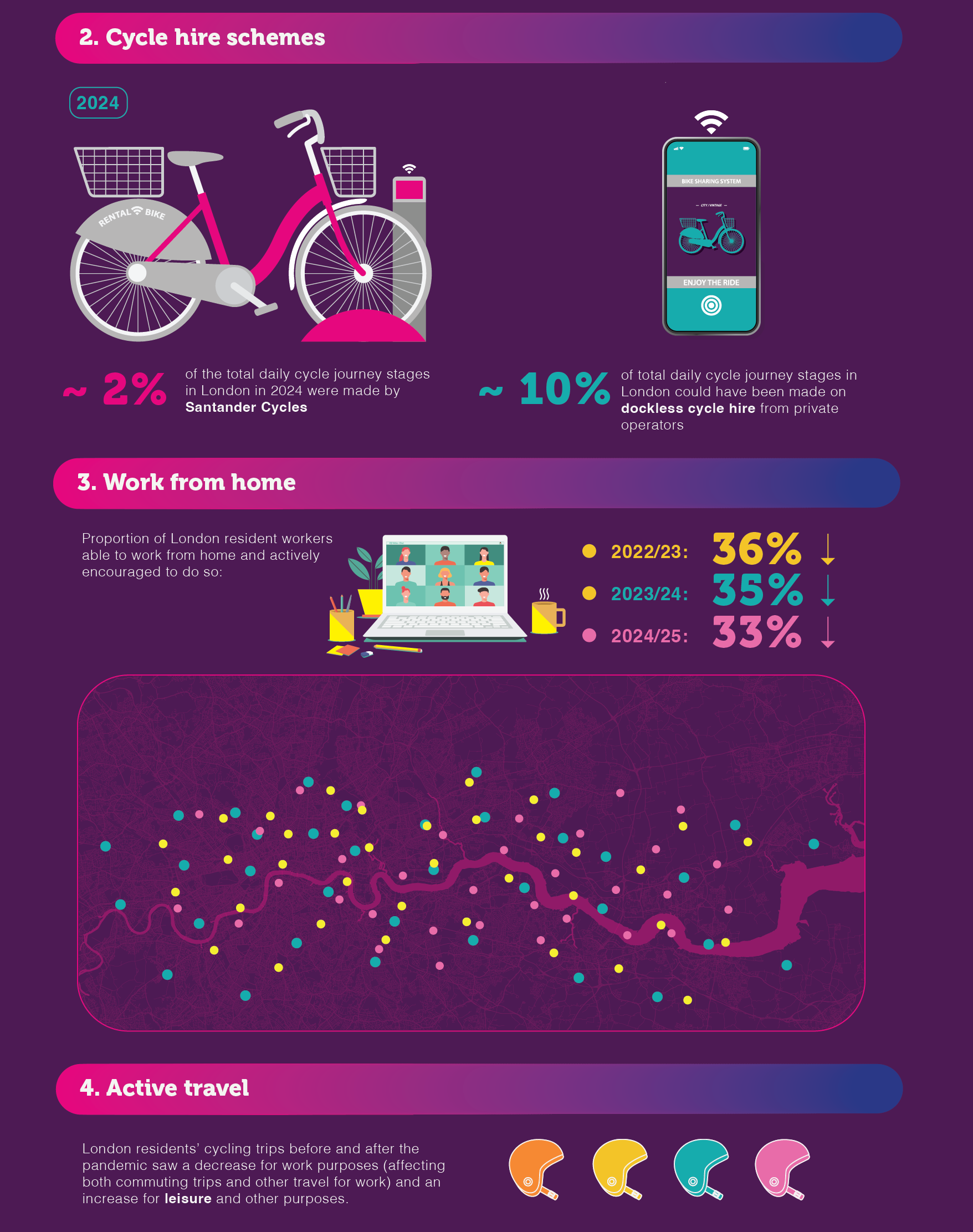

Despite the overall rise in cycle journeys, TfL’s analysis shows commuting trips as a proportion of cycling activity have declined. Since 2019, commuting has fallen from 36% of cycling journey purposes to 31%, with leisure trips now the predominant reason people cycle.

Furthermore, if cycling is considered as a mode share rather than in absolute numbers, the apparent growth in cycle trips becomes less clear. Traffic counts and ticket analysis from TfL suggest that cycling accounted for around 4.7% of all trips in London in 2024, up from 3.6% in 2019. However, for understanding commuting behaviour, it’s best to reflect on a second set of mode‑share data published by TfL, drawn from the London Travel Demand Survey.

This dataset provides the most robust picture of travel behaviour among London residents and shows that the cycling mode share has remained stagnant at around 3% since 2019. This indicates that while cycling trips have increased, cycling has not become a larger share of residents’ travel. Applied to an individual office building, this implies no strong reason to expect increased cycling demand.

It is also worth noting the growing role of cycle hire in the number of cycle trips. It is estimated by TfL that 12% of cycling trips are made using hire bikes. These trips, especially concentrated in central London, do not generate demand for long-stay workplace cycle parking.

These trends underpin the findings of CPA’s Cycling and the City report, which examines what constitutes an attainable cycling mode share for an office development in the Square Mile. A key constraint identified is commuting distance, with 64% of the City’s workforce living more than 10km from their workplace, regarded as the upper limit for cycle commutes. While the current London Plan is looking to provide cycle parking for a 19% cycle commuting mode share, the CPA report forecasts that this is unlikely to rise beyond 11%.

Whilst cycle numbers in London show growth, it is evident that this should not automatically be assumed to apply across all trip purposes or all Londoners. It’s essential that we plan for growth in cycling, but it also needs to be aligned with what the data is telling us, what is possible and what sustainable growth looks like for the City of London.

Read our Cycling & the City report here